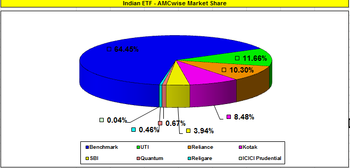

Goldman Sachs has agreed to buy India's Benchmark Asset Management, a major provider of ETFs. Benchmark Asset Management was founded in 2001 and had about $700 million in assets under management as of Dec. 31. As of last year, Benchmark had nearly 65% marketshare of the Indian ETF market, and its gold ETF was the first and largest, in terms of AUM. Benchmark previously held almost $2 billion in AUM over its productline (2008 data). Terms of the deal were not disclosed.

Goldman, which has had a license to offer investment-banking services in India since 2008, said it planned to launch actively managed on-shore funds in India. The firm is also planning a major push in Korea, targeting its increasingly wealthy population. Benchmark Asset Management is known for its Gold ETF, but also offers six equity, one international and one fixed income ETFs.

FPR Commentary: Benchmark and Goldman will face the onerous task of competing against iShares, European and local banks in the increasingly relevant Indian wealth management space. However, Goldman now has the strategic advantage of owning the most established ETF provider in India. Amongst the benefits that will accrue to Goldman are a) knowledge on the local markets, b) regulatory connections and c) established local distribution. The firms are indirectly hoping to preempt iShares, ETF Securities, (and eventually T Rowe Price through its ownership of UTI Asset Management Co) from gaining advantage in India. However, it has been a tough job for Benchmark to convince the Indian newly-rich to embrace ETFs. Distribution efforts have suffered due to the extensive resources required in educating local investors and advisors on the benefits of exchange traded funds. Further, Indian rich are traditionally known for investing in physical gold. Some seem reluctant to embrace the concept of ' gold fund that charges annual expenses' unless a larger global brand is behind it. And this is where Goldman's name comes in. Given the benefits ETFs offer (such as low cost, transparency, and ease-of-transaction), it will be a slow but steady march towards winning the trust of India's wealthy. As the emerging markets continue to correct down, FPR expects to see more global M&A activity in that corner of the world. Activity that will effectively redefine the battle for India's wealth, through smart alliances and global partnerships.

P.S. To all ETF Business Review subscribers, here is the website of Benchmark in India

<script src="http://cdn.wibiya.com/Toolbars/dir_0862/Toolbar_862239/Loader_862239.js" ></script><noscript><a href="http://www.wibiya.com/">Web Toolbar by Wibiya</a></noscript>

RSS Feed

RSS Feed