Franklin Templeton will launch its first ETF on Tuesday, after months of mixed signals. The Franklin Short Duration U.S. Government ETF is an active ETF and will cost 30 basis points. The AETF targets an estimated average portfolio duration of 3 years or less. It will invest in government securities at nearly 80% of assets. The filing also mentions gov. credit derivatives.

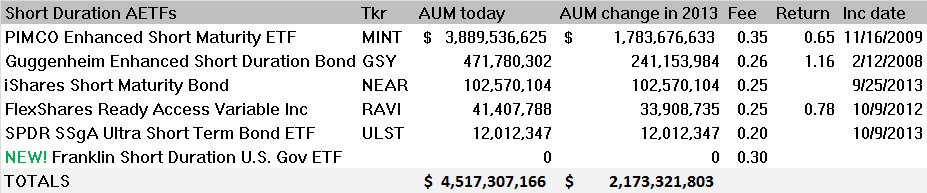

Analysis: Franklin’s AETF is a copycat sixth-to-market fund. It will join five other similar AETFs (see table) from competing asset managers such as FlexShares, SSgA, Guggenheim, and PIMCO, who are years ahead in product innovation in ETFs compared to Franklin Templeton. It looks, as if Franklin assumes, that pricing this ETF at a premium, compared to its competitors (with exception of PIMCO’s MINT), will magically work with advisors. Given that Treasuries could be bought at no cost, the premium pricing of this AETF signals Franklin's product team is out of touch with the the market's reality (blame the seven figures consultants). This will backfire and it will be quickly adjusted. Still, given Franklin Templeton’s established relationships, expect this ETF to reach at least $100 million by end of 2014 or earlier. See the table below for competing AETFs (active ETFs). Read the filing here.

(Note: to read more, sign at our front page for the ETF Business Review -- the leading fund intelligence for institutional investors.)

Analysis: Franklin’s AETF is a copycat sixth-to-market fund. It will join five other similar AETFs (see table) from competing asset managers such as FlexShares, SSgA, Guggenheim, and PIMCO, who are years ahead in product innovation in ETFs compared to Franklin Templeton. It looks, as if Franklin assumes, that pricing this ETF at a premium, compared to its competitors (with exception of PIMCO’s MINT), will magically work with advisors. Given that Treasuries could be bought at no cost, the premium pricing of this AETF signals Franklin's product team is out of touch with the the market's reality (blame the seven figures consultants). This will backfire and it will be quickly adjusted. Still, given Franklin Templeton’s established relationships, expect this ETF to reach at least $100 million by end of 2014 or earlier. See the table below for competing AETFs (active ETFs). Read the filing here.

(Note: to read more, sign at our front page for the ETF Business Review -- the leading fund intelligence for institutional investors.)

RSS Feed

RSS Feed