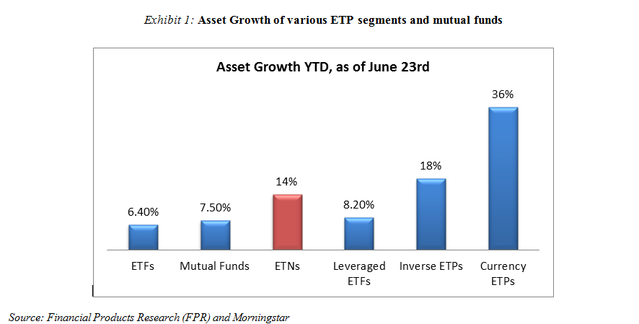

The ETN market continues to grow. ETNs grew faster than both, mutual fund and ETF offerings in 2011 (see chart below), as of June 23rd, YTD. Earlier this year, we projected ETN assets to reach $23 billion by the end of 2011. However, we have been too optimistic. ETNs are now growing at a slower rate: total ETN universe grew 14% since end of 2010, as of June 23rd. ETNs hold $16 billion, which is up from $14 billion at the end of 2010. Amongst the colorful array of ETNs, more than 50% of them are in commodity-tracking offerings, ($8.6 bill), and volatility-related ETNs hold $2.1 bill. Another $3 bill is in energy-related MLP offerings. Agriculture related products hold close to $1.6 billion. Out of the 189 new ETP products launched in 2011, 36 were ETNs. Going forward, much of the growth in ETNs is expected to come from trader-oriented and alternatives-targeting products, areas that are challenging to package in ETF wrappers. Despite the credit risk associated with these products, ETNs serve as ideal instruments for placing precise bets on hard-to-reach areas of the marketplace.

(extracted from this week's ETF Business Review, issue 76)

(extracted from this week's ETF Business Review, issue 76)

RSS Feed

RSS Feed