For those of you subscribers of the ETFBR, the news are great. As Rob Ivanoff predicted back in May, JP Morgan has just received a green light, to launch the first physical copper ETF in the world. Expect iShares to also get a green light, as they have filed for a similar ETF - but theirs will hold twice the size requested by JP Morgan (still, Mr. Dimon shoots faster than Larry Fink these days). J.P. Morgan’s copper trust is looking to register 6.19 million shares, or 61,800 metric tons, of copper. The trust will hold “grade A” copper in physical form, and hold no copper futures. The copper will be stored in LME -approved warehouses in the Netherlands, Singapore, South Korea, China and the U.S.

Over the past two years, the ETF Business Review published opinions in which we analyzed the pros and cons of all parties on both sides. In one of the opinions we concluded: "The market will embrace a physical-based copper ETF when it arrives. In fact, there will be a room for a number of them, similarly to gold. It is possible that the high cost of storing copper will hurt the fund in the short term, but we must assume that the cost will come down with assets going up. Expect competition in this space to increase from future-based metal ETNs and ETFs, specifically similar ETPs based abroad, which will cut their pricing in order to compete."

To read SEC notice of approval for JP Morgan click here. Below is the conclusion from our report summary, from May 2012.

FINANCIAL PRODUCTS RESEARCH

|

3 Comments

The big news are out: SEC will allow derivatives in active ETFs. This is a revolutionary development and it will serve as a catalyst behind the most amazing transformation of the fund business. (to read SEC's speech click here)

What does this mean for the fund industry?

Atlas has un-shrugged. To join the ETF Business Review and sign here or contact me at rob.ivanoff@financialproductsresearch.com Celebrating our 150th issue with a leading article "Austerity farm or a highway to print: what will you tell investors?" Thank you to all our readers on 3 continents!

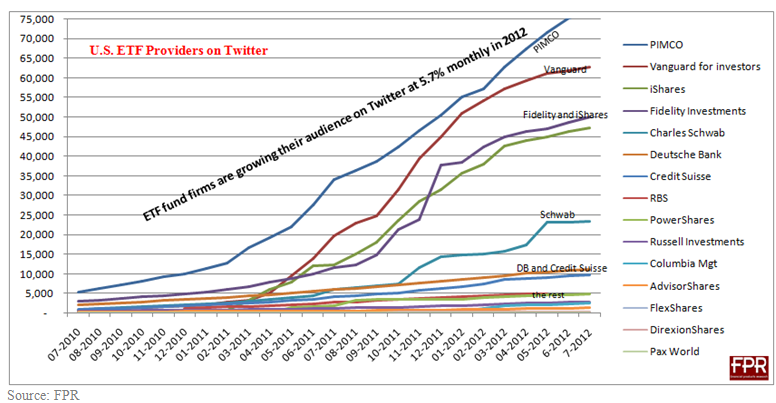

ETF firms continue to utilize Twitter, although growth is slowing down. Our subscribers last month benefited from the latest analysis on this important topic, which we have maintained since the early days of Twitter. And while only 30% of the ETF industry is utilizing Twitter, that number is 62% for Fortune 500 companies. Subscribe for our ETF Business Review weekly to learn more and get our great ideas for using Twitter more effectively.

ProShares filed for active ETFs with SEC. The filing queries a broad permission for AETFs in stocks, bonds and currencies. In particular, the firm has detailed ProShares Emerging Market Debt ETF. Competition: WisdomTree has an emerging market debt AETF already on the market. The ELD has been one of the hottest entrants - but as of late, it has failed to pull new assets. It peaked at $1.1 billion late last year and it is expected to sit out 2012 flat, in lieu of collapsing Asian-growth story. Then, there are the passive EM debt ETFs. Despite all, ProShares is targeting a clever corner of the market. Packed with mystery, aka diversification possibilities -- EM debt is not frequented by bronco U.S. managers. Past studies have also shown, second-movers commonly match the net sales of first-entry offshoots. But roadblocks remain. Notably, late timing, until further details are disclosed. To read this filing please click here. (Rob Ivanoff)

Franklin Templeton is the latest fund firm to file for an active ETF. The AETF will be very similar to PIMCO's MINT, and Guggenheim's GSY. The initial fund is named Franklin Templeton Short Duration Government ETF. Expense ratios were not disclosed. If ever launched, FPR believes the fund can actually generate around $100 million in AUM in short order - if there are no significant changes on the market by then. The current wait for active ETFs is 1-2 years. That is because SEC is mandated to take a gradual approach to allowing innovation. As per our report "12 Megatrends for the ETF Market 2012-2015" - FPR advises fund firms to think offensive, not defensive with AETF strategy. To get this report - click on our website and become a fund client of the ETF Business Review. Attached below is the filing - click on full screen to read it. Why is it so hard for Greece and Spain to sell national assets (sell islands, sell territory) to pay for their debts, instead of tapping prudent savers to sponsor more collectivism, more inflation, and dysfunctional administrations? It is time for hard assets to be sold as gallows for paper befuddlement. Absent of that, the alternatives will only prop the deadly socialist utopia.

The ETF Business Review is not in the business of predicting market drops. We are in the business of improving the bottom-line of fund companies and asset managers. We are in the business of knowing what funds will sell, where and why. And just by our nature, we understand how international links impact the market. This is why fund firms have voted with their feet in signing with us. Very often, we make market calls, like the one below from May 7th. Since this prediction of impending correction, the S&P 500 is down nearly 700 basis points. To benefit our readers, we are including a short narrative of the ETF Business Review, May 7th:

May 7, Boston, MA: Welcome to the 121th weekly issue of the ETF Business Review. As of this writing, the equity markets globally have been breaking down in terms of breadth and leadership. Last night we learned that France has elected a socialist President - that is not going to play well with Germany, as the French will pressure for easy solutions, high taxation of the wealthy, and no real reforms. The EU and its currency will continue to break down. Nationalistic attitudes, tariffs and border checks will ensue. At the same time in the U.S., we face insurmountable fiscal, budget and high taxation problems. The situation is not that rosy in China, although they do hold the world's manufacturing - one of the reasons why the rest of the world is catching fire. And there is not much politicians can do but make things worse. Take a look at the Gallup poll in this issue - investors are clinging to savings and gold, this is why mutual fund flows have been unimpressive here and in Europe. It is becoming likely, we are going to see a correction of 5-15% take place. Potentially such weakness will be countered by more global central bank printing. This will play well for high-income ETFs, Obama, and...inflation. In other news, we learned that Vanguard is planning to launch its active ETFs in two months' time. We also learned Senate will continue to re-engineer ETF regulation through additional time-wasting meetings. It seems very 'wrong' in DC to keep things simple - and let the market work its magic. Last, do not forget that this week we have the IMN ETF conference in Boston, and the ICI general meeting in DC. |

THE ETF BUSINESS REVIEW BLOGArchives

March 2015

Categories

All

|

RSS Feed

RSS Feed